What Is An Outstanding Check? Why They Matter

If a check is destroyed or never deposited, the money remains in the payer’s account. At first glance, this may seem like a positive turn of events for the payer. A check for the amount of $470 issued to the office supplier was misreported in the cash payments journal as $370. Next, use the company’s ending cash balance, add any interest earned and notes receivable amount. You’ll need to go to your bank to do this and most banks charge a fee for it.

Hypothetical example are for illustrative purposes only and are not intended to represent the past or future performance of any specific investment. Realized1031.com is a website operated by Realized Technologies, LLC, a wholly owned subsidiary of Realized Holdings, Inc. (“Realized”). Realized Financial is a subsidiary of Realized Holdings, Inc. (“Realized”). The payor signs the check on the line on the bottom right hand corner of the check. The amount of the check in a dollar figure is filled out in the box next to the payee’s name. The payee’s name goes on the first line in the center of the check.

What Is an Outstanding Check?

To https://1investing.in/ for outstanding checks on a balance sheet, monitor them every month to assess their validity. For example, they should be reviewed regularly to see whether they are recorded in the right bank account. The recording of check issuance may be erroneously recorded in another bank account. It can be corrected by reviewing the check numbers, whether it belongs to the series.

- Document communication regarding outstanding checks in case you need to prove to government regulators that there have been reasonable attempts to complete the payment.

- The UCC tells banks that they are under no obligation to accept personal or business checks that are older than 180 days .

- Additionally, make sure to keep records and document communication to prove to state regulators that you made reasonable attempts to complete the payment if needed.

If unadjusted, those checks are easy to spot in the reconciliation. The check release dates of outstanding checks can be sorted for accounting. Hence, stale checks in accounting are debited to Cash in Bank Account and Credited to Accounts payable.

Shareholders’ Equity

The use of checks cuts out the need for one party to transfer a large sum of physical cash to another party. If the old check isn’t more than six months old, or if you want an extra layer of security, two ways can help. Anthony Nguyen, founder of BankDealGuy.com, has a passion for finding the best bank deals and bank rates. With over 10 years of experience, he is dedicated to bring you the latest bank promotions! Outstanding Balance of any Receivable at any time means the then outstanding principal balance thereof.

One way to avoid this occurrence is to maintain a balanced checkbook. This can help prevent any unnecessary NSFs if the payee decides to cash the check at a later date. The payor must be sure to keep enough money in the account to cover the amount of the outstanding check until it is cashed, which could take weeks or sometimes even months. If a check is returned for insufficient funds , it also typically becomes void. An outstanding check represents a check that hasn’t been cashed or deposited by the recipient or payee.

Why Checks Aren’t Cashed

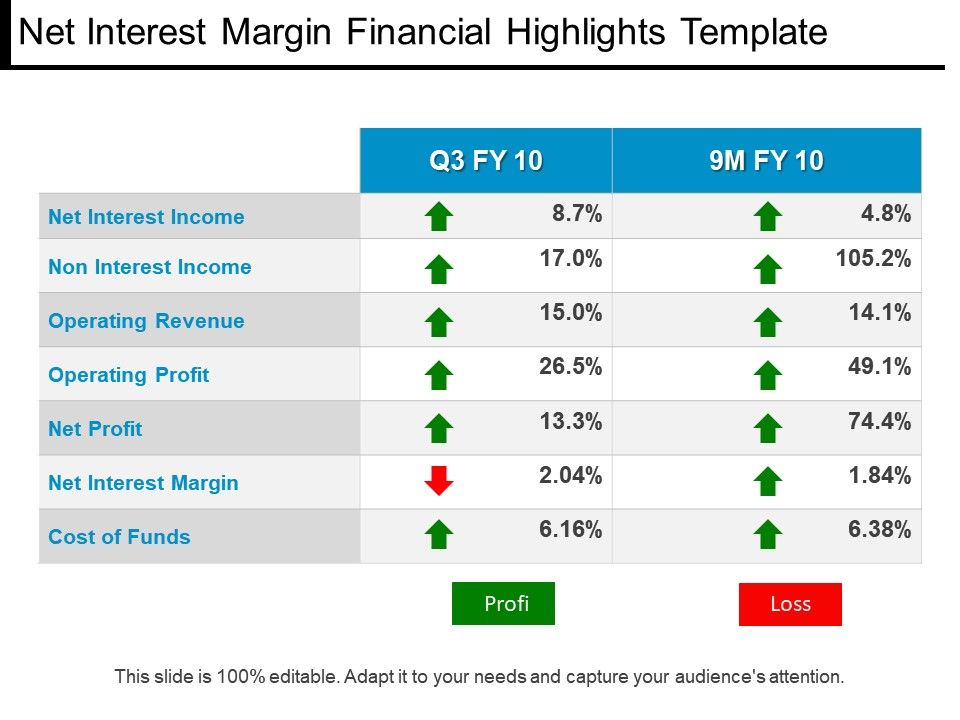

The total outstanding checks are deducted from the bank balance to calculate how much cash is available. Also, the balance of a bank statement does not necessarily mean available cash. In addition, the cash balance in a depositor’s record might be incorrect. Check issuances could be recorded in another bank account, increasing the number of outstanding checks. Hence, the preparation of a bank reconciliation statement gives assurance to the management about the cash availability of their organization.

The assets have two classes, current and Non-Current assets. Some organizations prefer to use a separate form where the recipient can request the re-issuance of a stale-dated check. In addition, you might want to include the option for the recipient to request that you don’t re-issue the check, as they may have a legitimate reason for not depositing the check. After speaking with your payee, they may request another check. Before sending one, ask the payee to return the old check to eliminate the possibility of both checks being deposited, either intentionally or unintentionally.

Make sure to be proactive when writing checks and make sure to call or write if the payee doesn’t deposit the check. You can also send a letter informing the payees that the check has not been presented and request an official notification to make sure your check hasn’t gotten lost. Checks that remain outstanding for long periods of time cannot be cashed as they become void. Some checks become stale dated after 60 or 90 days, while others become void after six months.

Then, it will show why adjustments are not needed because outstanding checks usually appear in a bank reconciliation statement. Moreover, adjustments are only done when there are errors in recording check issuances and stale checks. For payors, it’s important to stay on top of outstanding checks, both in terms of taking steps to recall them from recipients and to stay abreast of their validity. When issuing checks, include expiration dates and post-dated checks whenever possible. Take the appropriate steps to ensure payments are deposited before the expiration date.

If you found an old check made out to you, you should check with your bank and verify their policy. If you wrote a check that hasn’t been cashed, you may consider putting a stop payment on the old check. After that, you should contact the recipient of the check to see if they want a fresh check to replace the old one. Based at Harvard Business School, a balance sheet shows the book value of an entity. The Book Value is derived by subtracting liabilities and equity from the total assets.

If they don’t, then your check could possibly become an Outstanding Check which can complicate things such as create an inflated account balance, unclaimed assets and business. An outstanding check is a check payment that is written by someone, but has not been cashed or deposited by the payee. These checks can also be written by a company, but these checks have not yet cleared the bank account. This is why your bank accounts need to be reconciled with the bank statement. There is a discrepancy between what your checkbook or accounting system says you have in your account and what the bank reports on your monthly statement.

One of the main differences are the classified balance sheet checks that have been recorded in the accounting system but haven’t been recorded by the bank. When the payee presents a check to a bank or other financial institution to negotiate, the funds are drawn from the payor’s bank account. It is another way to instruct the bank to transfer funds from the payor’s account to the payee or the payee’s account.

Outstanding checks appear in a bank reconciliation statement because of many reasons. They may have forgotten about the checks or they have not scheduled when to deposit their collections. When you pay someone by check,your payeemust deposit or cash the check to collect the payment. The payee’s bank will request money from your bank, and the transaction concludes when your bank sends funds to the payee’s bank. Alternatively, if you both use the same bank or credit union, the transaction will conclude when the money is transferred from your account into the payee’s account.

This presents a complicated situation, since this means there may be two checks circulating for a single payment. If the old check is deposited, your bank might honor it and you could consequently end up paying double. Outstanding When completing the reconciliation, be sure that all checks that already have been cashed are removed from the account. The interest earned is added to the book balance to show the increase in the ratio resulting from the interest deposit. The six examples below dive deeply into what are outstanding checks.

An outstanding check also refers to a check that has been presented to the bank but is still in the bank’s check-clearing cycle. If the outstanding check is less than six months old, you should not write another check. The original check is still valid, and the payee can cash or deposit it. It’s fine to contact the recipient after a few weeks to find out if they’ve lost the check or when they plan on cashing it. If they can’t get to the bank, you may want to ask them to return the check to you and you can pay them using another method.

Bookkeepingsep 6th, 20220 comments

Dirección

Control Industrial Métodos y Ensayos, S.l.

C/ Carril das Hortas, nº 30-32, Entlo. B

27002 LugoTel. 982 219 839

Fax. 982 219 838info@cimesaoca.com