Category Archives

Bookkeeping

Period Costs: What Small Businesses Need to Know

Contents:

The standard costs that a business incurs that are not directly related to production operations or inventory costs but still must be added to their income statement are known as period costs. Items that are not period costs are those costs included in prepaid expenses, such as prepaid rent. Also, costs included in inventory, such as direct labor, direct materials, and manufacturing overhead, are not classified as period costs. Finally, costs included in fixed assets, such as purchased assets and capitalized interest, are not considered to be period costs.

Epidemiology of Endometriosis Awareness in Turkey Article – Cureus

Epidemiology of Endometriosis Awareness in Turkey Article.

Posted: Thu, 13 Apr 2023 17:57:10 GMT [source]

Period costs are costs that are not involved directly in the manufacturing process of inventories. In other words, they are the expenses paid on non-manufacturing activities. Let’s look at a few examples of period costs to illustrate the concept.

The Difference Between Product vs. Period Cost

The product costs are the costs incurred by a company directly related to the production of goods. In sum, product costs are inventoried on the balance sheet before being expensed on the income statement. The period cost is important and a necessary thing to keep track of because it allows you to know your company’s net income for each accounting period. Keeping track of the period of cost is also important for filing accurate business taxes and for preparing for an audit. Tracking period costs will also help a business balance its budget and gain savings.

While product costs are often variable as they directly relate to the quantity of units produced, things like operational spaces and machinery maintenance can be fixed. Following accounting standards, the cost of inventory, or cost of goods sold, is any cost incurred to get inventory ready to be sold. In the case of manufacturers, it is any cost incurred to produce the products to be able to sell them. It is important to note that personnel outside production activity e.g. administration or sales staff are accounted for neither as direct labour nor manufacturing overheads.

Product vs. period costs: What’s the difference?

In other words, manufacturers incur product costs to produce inventories. Therefore, the cost of inventories is the same as product costs. Since inventories are recorded as assets for the manufacturers, product costs are recorded on the balance sheet in the assets section under inventories.

Therefore, outstanding checks on the above agreements, we can conclude that these advertisement costs should be treated as period costs, not product costs. Period costs include selling and distribution expenses, and general and administrative expenses. These costs are presented directly as deductions against revenues in the income statement. These costs are included as part of inventory and are charged against revenues as cost of sales only when the products are sold.

In addition to categorizing costs as manufacturing and nonmanufacturing, they can also be categorized as either product costs or period costs. This classification relates to the matching principle of financial accounting. Therefore, before talking about how a product cost differs from a period cost, we need to look at what the matching principle says about the recognition of costs.

Examples of Period Cost

Period costs are expensed on the income statement when they are incurred. When a company spends money on an advertising campaign, it debits advertising expense and credits cash. These costs are directly expenses and reported on theincome statement. Now let’s look at a hypothetical example of costs incurred by a company and see if such costs are period costs or product costs.

For example, the fee for a consulting service offered by external management consultants are PCs, but they are not mentioned in any of the categories above. Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. You will need to follow these steps to calculate the period cost.

Selling

They are identified with measured https://1investing.in/ intervals and not with goods or services. Period costs can be defined as any cost or expense items listed in the firm’s income statement. Examples of period costs include selling and administrative expenses. Both of these types of expenses are considered period costs because they are related to the services consumed over the period in question.

- Finally, both executives’ salaries are period costs since they also do not work on the production floor.

- All costs in the income statement other than cost of goods sold.

- Overhead, or the costs to keep the lights on, so to speak, such as utility bills, insurance, and rent, are not directly related to production.

- In a manufacturing organization, an important difference exists between product costs and period costs.

- This inventory remains as an asset until the goods are sold, at which point the inventory is gone, and the cost of the inventory is transferred to cost of goods sold on the income statement.

- You will have to categorize their costs as either product or period costs and prepare the income statement for March 2022.

On the other hand, costs of goods sold related to product costs are expensed on the income statement when the inventory is sold. A few good examples of period costs are advertising and administrative salaries. Advertising expenses can’t really be allocated to a specific manufacturing process or even a product. Advertising costs are easier to attribute to a time period for instance the advertising budget for the current year. Other general and administrative costs like office salaries can’t be allocated to products.

Example of Period Costs

Next, one needs to select the period costs out of these expenses. Rent expense for the manufacturing facility is not a period cost since it is related to product manufacturing. However, rent expense for the office is since production does not take place in the office. The manufacturing facility manager’s salary is not a period expense since it is considered a manufacturing overhead cost. On the other hand, the administrative assistant’s salary is a period cost since she works in the office and not on the production floor. Finally, both executives’ salaries are period costs since they also do not work on the production floor.

- A direct cost is a price that can be completely attributed to the production of specific goods or services.

- Per-unit cost is calculated by dividing your costs by the number of units produced.

- Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites.

- Costs are classified as period costs if they are non-manufacturing costs incurred during the period.

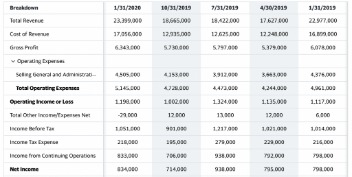

Consider this company’s traditional income statement from 2019. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Factory overheads, and they are traceable or assignable to products. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. These costs should be monitored closely so managers can find ways to reduce the amount paid when possible.

PVDF Membrane Market Size & Share to Surpass $1086.1 Million … – GlobeNewswire

PVDF Membrane Market Size & Share to Surpass $1086.1 Million ….

Posted: Thu, 13 Apr 2023 10:26:24 GMT [source]

Depending on whether an expense is involved in the production process or not, it could be classified either as a product cost or a period cost. That would depend on whether the depreciation is on property and equipment related to the manufacturing process or not. When a product cost is incurred, we credit the expense to get rid of it and debit an account called “work in process.”

As mentioned before, there is no clear formula for calculating period costs. A product cost is a cost of producing the manufactured product. The most common product costs are direct materials, direct labor, and manufacturing overhead. Both of these costs are considered period costs because selling and administrative expenses are used up over the same period in which they originate. The costs are not related to the production of inventory and are therefore expensed in the period incurred.

Anmeldelse af Whacked Slot: Afdække den vilde verden af onlinespil

Introduktion

I den evigt udviklende verden af online casinoer, kan man ikke ignorere forlokkelsen ved spilleautomater. De kommer i forskellige temaer og designs, der tilgodeser en bred vifte af præferencer. Blandt overfloden af muligheder har spilleautomaten “Whacked” skabt en del buzz. I denne anmeldelse vil vi dykke dybt ind i Whackeds verden og udforske dens funktioner, gameplay og overordnede appel.

En vild tur

Whacked er et slotspil, der transporterer spillere ind i en vild og levende verden. Spillets grafik er intet mindre end imponerende, med levende farver og iøjnefaldende animationer, der straks trækker spillere ind i dets unikke univers. Temaet kredser om et finurligt karneval, komplet med cirkusakter, karnevalsspil og skæve karakterer. Disse livlige rammer sætter scenen for en spændende spiloplevelse.

Gameplay

Et af nøgleelementerne, der adskiller Whacked fra andre spilleautomater, er dets gameplay. Denne slot er udviklet af et kendt spillestudie og tilbyder et forfriskende twist på traditionelt gameplay. Spillet har fem hjul og 25 betalingslinjer, hvilket giver spillerne rig mulighed for at vinde. Men det, der virkelig adskiller Whacked, er dets bonusfunktioner.

Bonusrunderne i Whacked er det, der får spillerne til at komme tilbage efter mere. Bonusspillet “Whack-a-Mole” er en fremtrædende funktion, som giver spillerne mulighed for at teste deres reflekser og tjene ekstra præmier ved at slå modermærker, når de dukker op på skærmen. Dette minispil tilføjer et element af interaktivitet, som sjældent ses i spilleautomater, og tilføjer et lag af spænding til den samlede oplevelse.

Wilds og scatters

Whacked inkluderer de klassiske spilleautomatelementer med wild-symboler og scatters, men med et unikt twist. Wild-symbolet, repræsenteret af et farverigt karnevalstelt, kan erstatte ethvert andet symbol på hjulene, hvilket øger dine chancer for at danne vinderkombinationer. Scatter-symbolet er på den anden side en karnevalsbillet, og landing af tre eller flere af disse udløser gratis spins-funktionen, hvilket giver spillerne en chance for at vinde stort uden at satse yderligere penge.

Indsatsområde

Whacked henvender sig til spillere på alle budgetter med et fleksibelt indsatsområde, der giver dig mulighed for at justere din indsats i henhold til dine præferencer. Uanset om du er en afslappet spiller, der leder efter noget underholdning eller en high roller, der søger store gevinster, imødekommer Whacked dine væddemålsbehov.

RTP og volatilitet

For dem, der kan lide at dykke ned i de tekniske aspekter af spilleautomater, er Return to Player (RTP) raten og volatiliteten afgørende faktorer at overveje. Whacked tilbyder en anstændig RTP-rate, hvilket giver spillere en fair chance for at vinde i det lange løb. Med hensyn til volatilitet falder den i mellemkategorien, hvilket skaber en balance mellem hyppige små gevinster og potentialet for større udbetalinger.

Konklusion

Afslutningsvis er Whacked et slotspil, der skiller sig ud i den overfyldte verden af online casinoer. Dens fængslende tema, engagerende gameplay og interaktive bonusfunktioner gør det til et topvalg for spillere, der søger både underholdning og muligheden for at vinde stort. Med sit fleksible indsatsområde og fair RTP-rate er Whacked velegnet til spillere på alle niveauer af erfaring og bankrolls.

Hvis du leder efter et slotspil, der kombinerer spændingen ved et karneval med spændingen ved potentielle gevinster, er Whacked et spil, der fortjener et spin. Fordyb dig i dens finurlige verden, slå nogle muldvarpe, og se om du kan afsløre de skjulte skatte, der venter i denne unikke og underholdende online spillemaskine.

U S. Chamber Comments to DOL on Proposed Rulemaking Regarding Employee or Independent Contractor Classification U.S. Chamber of Commerce

Content

The proposed rule would not have substantial direct effects on the States, on the relationship between the National Government and the States, or on the distribution of power and responsibilities among the various levels of government. A cook has prepared meals for an entertainment venue continuously for several years. The cook prepares meals as directed by the venue, depending on the size and specifics of the event. The cook only prepares food for the entertainment venue, which has regularly scheduled events each week.

But, the class did include those meeting such criteria as to “claims brought by the same workers for their work after 1990″ when many of them had been transferred to the temporary employment agencies. This new definition excluded all groups not reclassified by the IRS or converted by Microsoft, any other “temps” hired post-conversion into the reclassified or converted positions, and all other common law employees not treated as employees by Microsoft. The trial court acknowledged that this redefinition reduced the class to “only a sliver of Microsoft’s contingent workforce.” The best way to avoid employee misclassification penalties is to make sure the person you want to hire abroad really is an independent contractor.

Using Contract Labor as a Tax Deductible Expense

Independent Contractor Rules Of Thumb law protections of independent contractors usually do not apply. The decision to hire an independent contractor represents a calculated business risk. Assess the risk of misclassification, including the dollar amount of payment and duration of relationship, probability that worker will voluntarily pay income tax withholding and social security self-employment tax, risk of liability for workplace injury, etc. The Department also states that an employee is in a “ontinuing relationship with the employer” while an independent contractor is in a “emporary relationship until project completed.” But, as explained above, the length of a contractual relationship is not a meaningful proxy to show economic dependence. The Department’s failure to be able to provide operational guidance will only be exacerbated if it enacts the “additional factors” prong of the Proposed Rule. Even courts using the ABC test to determine employee status recognize that compliance with legal obligations is not indicative of control.

In review: entering the employment relationship in Denmark – Lexology

In review: entering the employment relationship in Denmark.

Posted: Wed, 01 Mar 2023 10:12:42 GMT [source]

Moreover, what animated the Fifth Circuit’s holding was the “nature of the employment”—oilfields are dangerous and, thus, requiring all workers to undergo safety training and drug testing was sensible and good policy. Accordingly, because “the reason for requirement applie equally to individuals who are in business for themselves and those who are employees, imposing the requirement not probative.” 86 Fed. Second, the Department contends that the 2021 IC Rule does not “comport” with the text of and case law construing the FLSA because it elevates the control and opportunity for profit/loss prongs, analyzes investment and initiative under the opportunity for profit/loss prong , and replaces the integral prong with the “integrated unit” inquiry. However, the Department was justified in fashioning the 2021 IC Rule in this manner.

Misclassified Workers Can File Social Security Tax Form

The Department welcomes comments and data on any costs to small businesses. Based on these inconclusive results, the Department believes it is inappropriate to conclude independent contractors generally earn a higher hourly wage than employees. The Department ran another hourly wage rate regression including additional variables to determine if independent contractors in underserved groups are impacted differently by including interaction terms for female independent contractors, Hispanic independent contractors, and Black independent contractors.

- Business lawyers should encourage their clients do so when additional workers are brought on, when the tenure and nature of the relationship changes, when the tasks expected of the worker expand or contract, or when other terms and conditions of the work change.

- Worker does not advertise her services or maintain a visible business location.

- The Department still believes that the 2021 IC Rule is the appropriate baseline, but notes that the current economic landscape may not be the same as a future situation without this proposed rule.

- Particularly in light of the consistency of the economic reality test as adopted by the circuits, the Department had for decades relied on subregulatory documents to provide generally applicable guidance for the Department and the regulated community on determining employee or independent contractor status under the FLSA.

- As rules and regulations for worker classification depend on each country, there is no easy one-size-fits-all test for employee misclassification.

The federal court found that the company misclassified the home workers as independent contractors rather than employees. As employees, the workers were entitled to at least minimum wage of $7.25 per hour. However, the investigation found that the company paid the workers on a piece rate basis based upon the amount of text messages to which they responded regardless of the number of hours they worked. When the workers’ hourly rate was calculated, it was discovered that the company was not providing the workers with at least $7.25 per hour in violation of the FLSA. Our law firm has filed an overtime lawsuit against Spectrum Financial Services, LLC pursuant to the Federal Labors Standard Act (“FLSA”). The federal lawsuit alleges that Spectrum Financial, a national staffing company, hired individuals across the country to work for its client, Accenture, as contract administrators.

Stay up-to-date with FindLaw’s newsletter for legal professionals

Look for evidence the worker is engaged in a distinct business or occupation requiring specialized skill. Every new regulatory decision results in familiarization costs, which is a deadweight loss imposed on society by the regulatory process of the administrative state. The Department has estimated that the initial familiarization cost for businesses, governments, and independent contractors of its Proposed Rule will be approximately $188 million dollars. The Department’s calculation of familiarization cost is rife with errors and omissions. On January 13, 2022, Martin & Martin, filed a federal lawsuit against Onyx Gentlemen’s Club in Atlanta on behalf of several strippers to recover owed wages and fees. Onyx reopened in February, 2021 and classified its dancers as independent contractors as opposed to employees.

On review, in an unusual unanimous decision, the Supreme Court held that where Congress failed to provide a meaningful definition of employee, the definition to be utilized was that of the “conventional master-servant relationship as understood by the common law agency doctrine.” However, if after retirement or termination the agent sold policies for a competitor within twenty-five miles of his home base or persuaded any Nationwide policyholder to cancel his policy, he “forfeited” his entitlement to any then unpaid benefits under the plan. “We conclude, therefore, that the determination of whether temps were Microsoft’s common law employees turns NOT on whether they were also employees of an agency, but rather on application of the Darden Factors to their relationship with Microsoft.” For example, operating without consulting business insurance can land you or your firm in hot water if a client sues.

Superior Care,840 F.2d at 1060 ; see also Off Duty Police,915 F.3d at 1060 (describing the control analysis as an inquiry into “whether the company retains the rightto dictate the manner of the worker’s performance”) . Off Duty Police,915 F.3d at 1060 (“Although workers could accept or reject assignments, multiple workers testified that would discipline them if they declined a job,” which was evidence of the employer’s ultimate control.). Additionally, even in cases in which a court did not consider control exerted over workers to comply with safety obligations as indicative of control, the court nevertheless concluded that such workers were employees under the FLSA. See, e.g., Scantland,721 F.3d at 1314 (finding workers to be employees, in part, because they “were subject to meaningful supervision and monitoring by” their employer). The 2021 IC Rule recognized that courts often analyze the exclusivity of the work relationship as part of the permanence factor, and the Department considered in its NPRM for that rule to include exclusivity under the permanence factor “to be more accurate.” 85 FR 60616.

- Submitting a contact form, sending a text message, making a phone call, or leaving a voicemail does not create an attorney-client relationship.

- Similarly, financial rules and regulations legally obligate broker-dealers to supervise the securities activities of affiliated financial advisors, regardless of whether they are considered employees or independent contractors.

- This document is meant to identify evaluation and review criteria in order to establish the appropriate relationship between Loyola University Chicago and the IC or employee.

- This 1099 tax form is what independent contractors use now, although it has been updated over time.

The 2021 IC Rule explained that independent contractors are not employees under the FLSA and are therefore not subject to the Act’s minimum wage, overtime pay, or recordkeeping requirements. It adopted an economic reality test under which a worker is an employee of an employer if that worker is economically dependent on the employer for work. By contrast, the worker is an independent contractor if the worker is in business for themself. Some courts of appeals have applied the factors with some variations.

Moreover, the power to decline work, and thus maintain a flexible schedule, is not alone persuasive evidence of independent contractor status when the employer can discipline a worker for doing so. Relatedly, the use of a personal vehicle that the worker already owns to perform work—or that the worker leases as required by the employer to perform work—is generally not an investment that is capital or entrepreneurial in nature. The Fifth Circuit likewise considers the purpose of the vehicle and how the worker uses it. For example, in Express Sixty-Minutes,it explained that, “lthough the driver’s investment of a vehicle is no small matter, that investment is somewhat diluted when one considers that the vehicle is also used by most drivers for personal purposes.” And in Brockv.

Additionally, while the examples help illustrate the application of particular factors of the economic reality test, no one factor is determinative of whether a worker is an employee or independent contractor. Extent to which the work performed is an integral part of the employer’s business.This factor considers whether the work performed is an integral part of the employer’s business. This factor does not depend on whether any individual worker in particular is an integral part of the business, but rather whether the function they perform is an integral part.

1-800Accountant Reviews Read Customer Service Reviews of 1800accountant com

Content

I am just very appreciative of everything, that Miss Jameson, and Jose, my tax advisor have helped me through. I feel comfortable making new moves with my business because i have a solid team handling the logistics of finances and taxes.

A) Salary.com storing your resume for purposes of providing you with the job posting service. We are currently seeking a tech-savvy self-started to join our team at our brand new office in Largo! At EY, you’ll have the chance to build a career as unique as you are, with the global scale, support, inclusive culture and technology to become the best version of you. At EY, you’ll have the chance to build a career as unique as you are, with the global scale, support, inclusive culture and technology to become the best version of you. Located in Midtown Manhattan, our staff is a diverse team of seasoned and growing career accountants. Led by our CEO, who was voted one of the country’s 50 best CEO’s in the United States by Glassdoor, 1-800Accountant is the country’s largest virtual accounting firm serving over 40,000 clients. Experience working with cross functional teams to develop products and services.

Reviews4.7

People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active. Her guidance and support during taxes season have been superb. Hello Jason, We regularly review our processes to ensure we’re delivering a superior customer experience and would like to investigate your complaint. At A Glance Accountant is looking for a highly motivated and self driven Sales Representative to join our sales team! This is an exciting opportunity to develop innovative strategies to achieve sales goals, as well as make meaningful connections with… B) Salary.com being able to use your name and address to tailor job posting to your geographic area.

- It’s the same interface we use internally, so when it comes time for our accountants, tax experts, and bookkeepers to have a conversation with clients, everyone is looking at the same information.

- For tax tips, insights, and more, curated to help your business grow.

- People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active.

- Bookkeeper responsibilities include managing a portfolio of clients with various levels of complexity, preparing monthly financial statements for clients , collaborating with each client…

- We also ensure all reviews are published without moderation.

Sign up to receive alerts about other jobs with skills like those required for the Remote Sales Representative. Sign up to receive alerts about other jobs that are on the Remote Sales Representative career path. Working Nomads curates remote digital jobs from around the web. Heavy phones in a fast paced environment, outbound calling +300 calls daily, comfortable speaking professionally on the phone. Please note that all salary figures are approximations based upon third party submissions to SimplyHired or its affiliates.

Position Classification Standards for White Collar Work

In accordance with federal and state laws, Lakes and Pines CAC is an equal opportunity employer, contractor and provider of services. The Agency will maintain a policy of non– discrimination with all employees and applicants for employment. Most Domino’s® stores are owned and operated by independent franchisees, not Domino’s Pizza LLC, Domino’s Pizza Franchising LLC, or Domino’s Pizza, Inc. (“Domino’s Corporate”). Each independent franchisee is a separate company that is not owned by Domino’s, and each franchisee is the sole employer of the individuals that work in its Domino’s® stores. Depending on the store you select, the job you apply for may be in a store owned and operated by an independent franchisee instead of Domino’s. If you are hired to work in a franchisee’s store, the independent franchisee will be your only employer.

We are looking for Customer Service Representatives with hustle, personality and people skills. Customer Service Representatives are responsible for greeting customers, answering phones, providing outstanding customer service. We accept The State of Texas Application for Employment for “Open” positions only. To view our current postings, go to WorkInTexas and click on “find state jobs” or if the position is open click on a Job Posting ID below.

Senior Accountant / Assistant Controller

If you have https://intuit-payroll.org/ or need assistance completing or participating in an independent franchisee’s application process, please contact that franchisee directly. She makes sure all of the Is and Ts are taken care of for bookkeeping and taxes . My s-corp business gets more of my time to drive sales for my clients versus bookkeeping and tax tasks. Was using QB from Intuit, but the human service at 800ACCOUNTANT exceeds Intuit’s inexperienced offshore customer service and software automation. Been with them since 2021 when Intuit blew it on my business taxes for S-Corp. 1-800Accountant is changing the way business owners think about accessing accounting services.

Who is the CEO of 1 800Accountant?

Mike Savage, is a CPA and CEO of 1-800Accountant, one of the premier virtual accounting firms in the U.S. trusted by over 200,000 small and medium-sized businesses across the country…

Employment applications will be kept on file for one year and will be considered for appropriate job vacancies. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. We value the diversity of our work force and the knowledge of our people. Read our Board Diversity Statement atey.com/us/diversity. We accept online applications only from direct applicants.

Job Posting for Remote Sales Representative at 1-800 ACCOUNTANT

Glassdoor gives you an inside look at what it’s like to work at 1-800Accountant, including salaries, reviews, office photos, and more. All content is posted anonymously by employees working at 1-800Accountant.

Recommend improvements in software to enhance user experience. We include these past jobs as a way for you to explore what kinds of remote and flexible jobs 1-800Accountant has hired for in the past and might be likely to hire for again in the future. See AppleCare options Learn more about Apple SupportFor more specialized help, connect with a certified Apple Consultant. Many offer onsite or virtual IT support, expertise in your industry, and custom tech solutions. They’ll advise you on the devices to fit your budget, including special pricing,1 and find you the best financing option.

1800Accountant offers uncapped commission, qualified leads, weekends off and full benefits. We needed a solution that would allow customers to interact with us directly, so we built that tool and developed it to the point where it could be customer-facing. Spinning that off helps us expand our market footprint, and there’s some added value in that it natively integrates with our portal. We wouldn’t have been able to produce ClientBooks without Finicity’s products and services. Don’t buy the idea that AI will replace everyone in traditionally people-driven industries. But, of course, that doesn’t mean we should shy away from technology disruptions. Our open banking platform provides the financial data you need.

Silver Alert Issued for 2 Women in a Red Jeep Compass – q1065.fm

Silver Alert Issued for 2 Women in a Red Jeep Compass.

Posted: Wed, 22 Feb 2023 18:13:22 GMT [source]

Our 1800 Accountant Jobs, Employment s don’t ask, “What technologies actually power this? In that way, Finicity gives our customers the assurance that their financial data is in good hands. Finicity helps us link to customers’ bank accounts and then automatically draw from their financial activity—things like transactions, statements, account history, and ACH—to populate their account in our portal. We can then reformat and represent that data in the customer’s books. That allows us to make a projection based on what we know of the business in real time.